Experiencing identity theft is a distressing ordeal that can leave you feeling vulnerable and, in some cases, result in financial loss. It can occur when someone gains unauthorized access to your bank account, social media profiles, or other personal information, using your identity for their financial benefit. This article outlines the essential steps to take if your identity has been stolen or misused, ensuring you remain protected.

Report to Affected Businesses and Financial Institutions

If the identity theft has compromised sensitive financial or personal information, promptly contact the affected businesses or financial institutions. This may include:

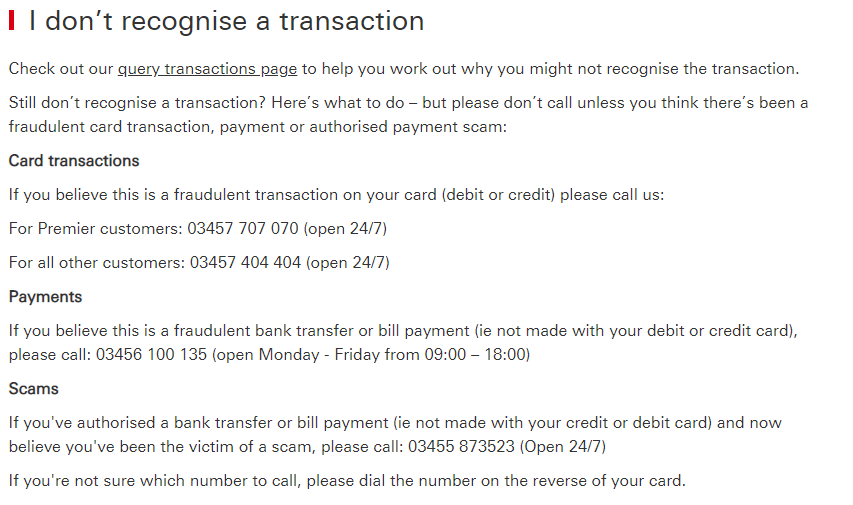

- Banks and credit card companies: Report any unauthorized charges or account breaches and request new account numbers or cards.

Contact your bank if you suspect your identity has been compromised. This precautionary measure helps secure your bank account and prevents the perpetrator from borrowing money in your name. Informing your bank enables them to block your cards and issue new ones. Most banks provide a 24-hour security hotline, so call promptly to minimize potential damage.

- Credit bureaus: Reach out to the three major credit bureaus (Equifax, Experian, and TransUnion) to place a fraud alert on your credit reports. This alerts potential creditors that your information has been compromised and requires them to take additional steps to verify your identity before extending credit.

Changing Your Social Security Number

You might wonder if you can change your Social Security number following identity theft. A different number can be assigned only under specific circumstances:

- Sequential numbers assigned to members of the same family are causing problems.

- More than one person is assigned or using the same number.

- A victim of identity theft has attempted to fix the issues resulting from misuse but continues to face disadvantages due to the original number.

- There is a situation of harassment, abuse, or life endangerment.

- Individuals have religious or cultural objections to certain numbers or digits in the original number. (Written documentation supporting the objection from a religious group with which the number holder has an established relationship is required.)

To request a different Social Security number, contact your local Social Security office for an in-person appointment. For more information on identity theft and your Social Security number, visit the Social Security Administration’s publication.

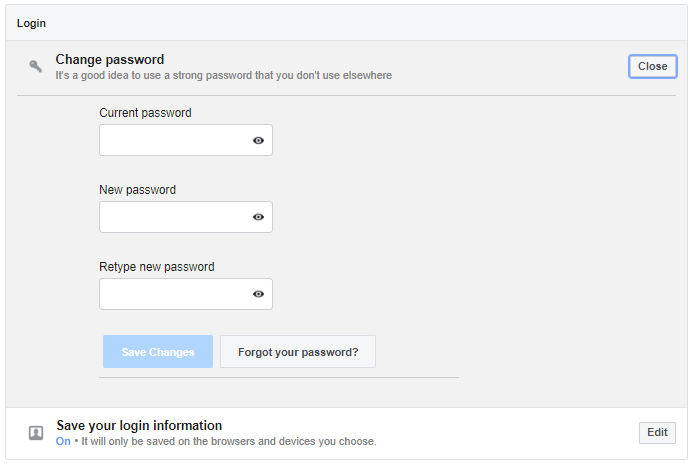

Change Your Passwords

Regardless of whether your online accounts have been directly compromised, change all your passwords as a precaution. If your identity has been stolen, the thief might attempt to access your various online accounts. Update as many passwords as possible and ensure all security information is current, allowing for rapid account recovery in case of a breach. Remember to enable two-factor authentication as well.

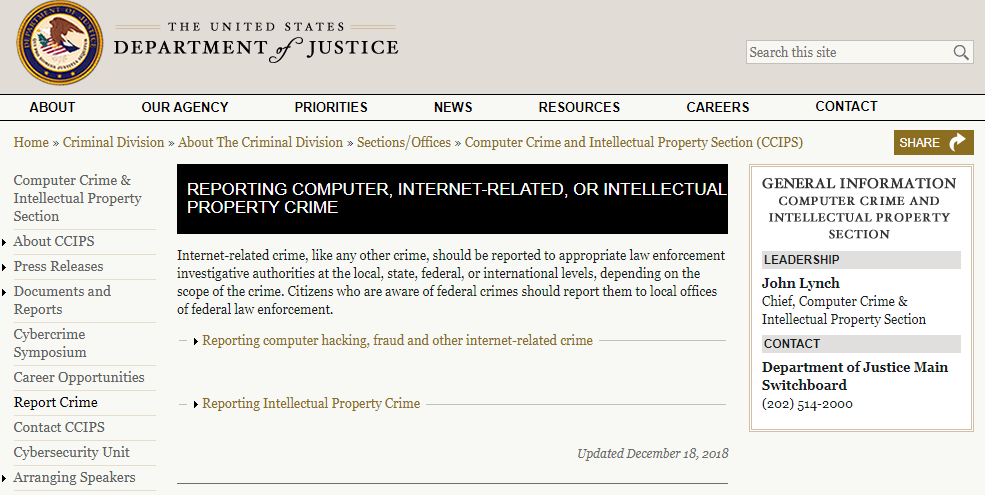

Contact the Police

Filing a police report is crucial when your identity has been stolen. Even if you manage to prevent severe damage, reporting the crime can aid the police in apprehending identity thieves and stopping future crimes. Gather as much information about the incident as possible before contacting local authorities to file a report.

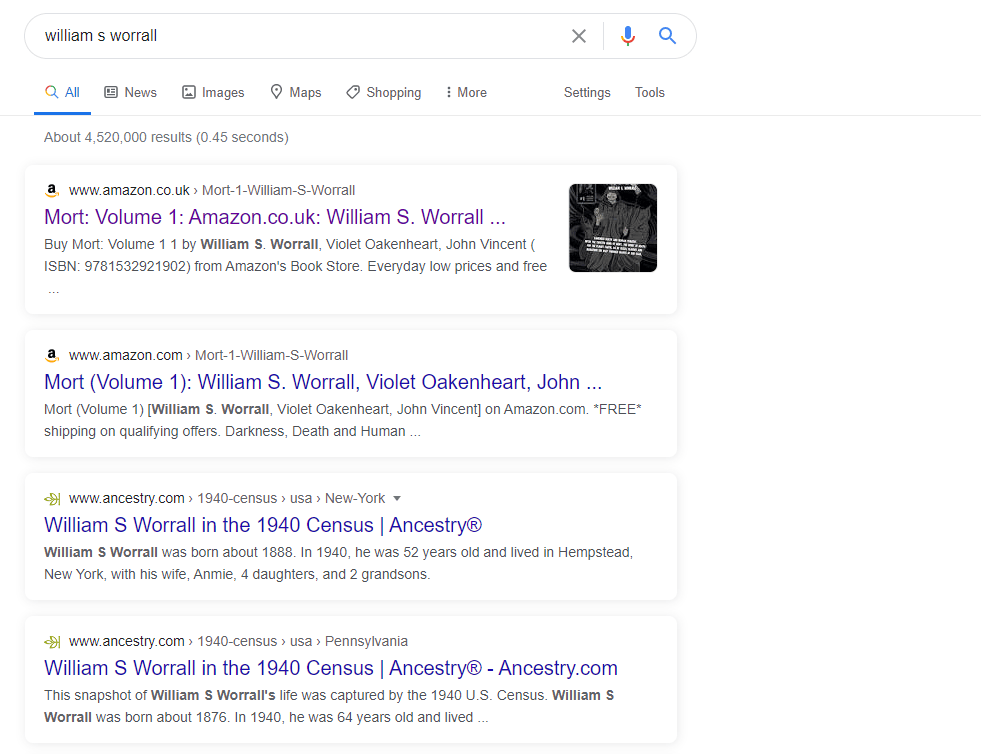

Check Google

If your identity has been stolen, there is a possibility that your personal information is being shared publicly. Perform a Google search to uncover any websites hosting your data. If you discover your information online, use Google’s tools to remove your personal information from their service.

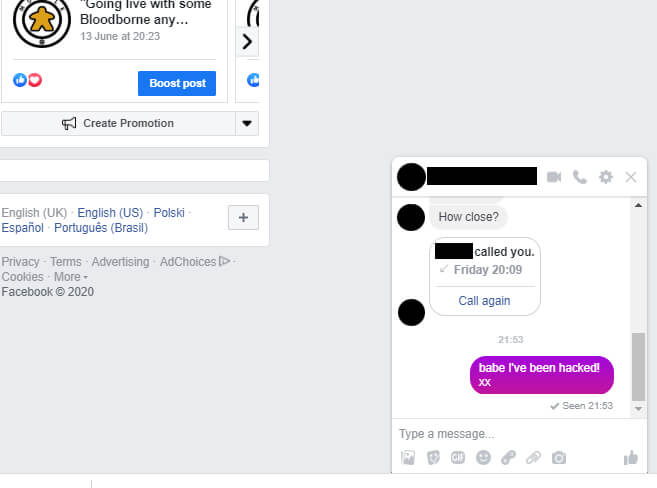

Inform Your Friends and Family

Notify your friends and family about the incident. This action allows them to be vigilant against anyone using your identity to deceive or scam them. Furthermore, sharing your experience and how your identity was stolen can help your loved ones be more cautious and prevent such incidents.

If you require advice regarding identity theft online, feel free to contact us, and we will gladly assist you.

Featured image by Scarlette from Shutterstock.com